Business Interruption Insurance

Keep Your Business on Track after a Claim

What is Business Interruption Insurance?

All business owners should seriously consider having business interruption coverage form part of their commercial property policy. Property policies and Business Interruption coverage goes hand in hand. In the event of a claim – one follows the other.

Property policies cover direct physical damage to insured property (think: equipment, machinery, office furniture, etc.) as the result of an insured peril (e.g. a fire). Business interruption insurance provides coverage for the loss of income during downtime, and/or extra expenses a business takes on as a result of that direct physical loss to the insured property. That means a physical loss, resulting from an insured peril, must occur first in order for the business interruption coverage to apply.

Need more information?

What are the Types of Business Interruption Coverage?

Profits

This is the best form for larger manufacturing and restaurant/hospitality risks where sales may be affected even after the repair or replacement of damaged property is completed.

Gross Earnings

The important difference from Profits coverage is that once the repair of the property is complete the coverage stops. This can be a problem if additional time is needed to replace lost contracts and/or get revenues back to normal. In this instance a Profits form is superior.

Ordinary Payroll

In order to retain your valuable employees during a claim, you can choose to insure your Ordinary Payroll, up to a specified period of time (i.e. 90 days, 180 days). When you consider the time and costs involved in recruitment and selection, this fund could be invaluable.

Gross Rents

This is best suited for businesses that rent property to others with long term leases, especially multi-tenanted risks. Similar to a Profits form in that indemnity continues past restoration date (subject to Indemnity Period limitation).

Extra Expenses

Extra Expense Insurance helps keep your business running after a loss. It covers additional costs in excess of normal operating expenses, such as: renting and moving to a temporary location, buying or leasing equipment, and outsourcing products and/or services during the transition.

How Long Does Business Interruption Coverage Last?

Business interruption claims stop when one of the following happens:

- The property is repaired (in the case of Gross Earnings coverage) or the profit levels are back to normal (in the case of Profits coverage);

- The indemnity period is over (typically 12 months); or

- The coverage limit is reached

Whichever comes first – the insurance claim will end.

Obviously, the first outcome is most ideal. We want to avoid situations where the claim is over because either time ran out or the coverage limit turned out to not be adequate.

As mentioned above, the standard indemnity period for business interruption losses are 12 months. Businesses should consider if they need to extend that period in cases where it may be a more difficult or complex process to get back up and running. For example, if a business relies on a specific piece of machinery that is not readily available and/or is difficult to replace, then it may make sense to think about a longer indemnity period.

Indemnity periods can often times be extended to 18 or 24 months, but keep in mind that you’ll also want to increase your limit to account for the longer claim time.

How Much Business Interruption Coverage Should I Buy?

Business income coverage is: revenue, less variable operating expenses, adjusted for opening and closing inventories of stock and work in progress. In other words, the amount of coverage selected should be sufficient to cover costs that will continue during downtime (i.e. fixed costs) plus the profit level of the business.

To help determine an appropriate limit, you can also complete what’s known as a Profits Worksheet. This worksheet will use a company’s financial data to put together an estimated coverage limit, but there are a couple things to keep in mind:

- The coverage limit will assume a 12 month period, so if you’re extended your Indemnity Period (as discussed above), you’ll want to adjust your limit too!

- Don’t forget about the future growth of the business! It’s highly recommended that the limit chosen for insurance should come from the annual estimated business income for the year AFTER the policy term.

- Keep in mind that if a claim were to happen on the last day of the policy, that claim will be paying for the loss of income going into the following year

What are Business Interruption Coverage Extensions?

Interruptions in supply chains could be another possible cause of loss of income. Many commercial property policies include coverage for Contingent Business Interruption, protecting against losses arising from disruptions to an company’s supply chain (either suppliers or customers). Typically, coverage would only respond in the event that a supplier’s or customer’s location was damaged by an insured peril (i.e. a peril that is also covered on the insured’s own policy). Be sure to talk to your broker if your business works with key suppliers and/or customers – as their operation could significantly impact your own.

Commercial property policies may also include coverage for business interruption losses and extra expenses when access to the insured property is prevented by a government order, sometimes referred to as Civil Authority. Typically, physical damage to either the insured or neighbouring premises would need to have occurred, triggering the order. Wordings vary, and some require the physical damage be caused by an insured peril on the policy, while others are broader and may include viral contamination.

What are Business Interruption Coverage Exclusions?

As no insurance policy covers everything, Business Interruption will also have exclusions. For example, “virus” and “disease” are often excluded from most policies. Another common exclusion is: “loss of market, use or occupancy of the property”. Given these common exclusions, policy wordings will need to be carefully reviewed.

Need More Information on Business Interruption Insurance?

Get in touch with a Staebler Commercial Solutions Broker. Click below to get started today!

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Business Interruption Insurance

Related Blog Posts

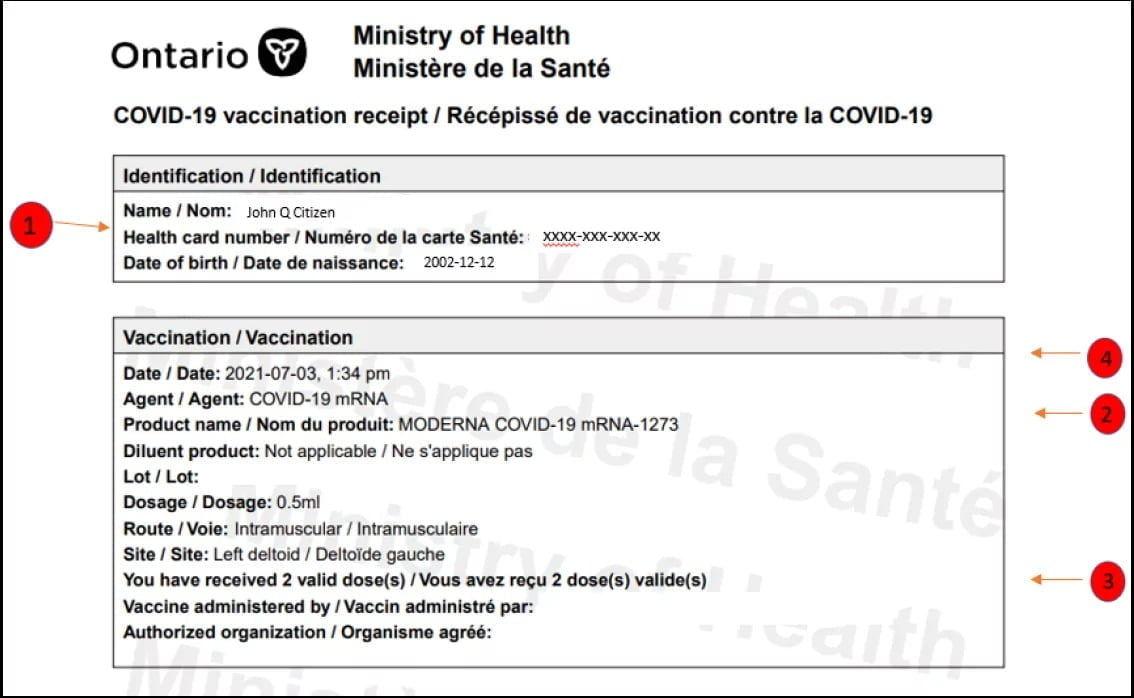

What Businesses Need to Know about Ontario’s Vaccination Certificates

Beginning Wednesday, September 22, 2021, the Province of Ontario is requiring proof of vaccination from patrons to enter select businesses. Ontario is joining other provinces with a vaccine certificate program that will eventually become a QR code (see update below)....

Why your Business needs Cyber Insurance in 2021

It’s becoming more frequent that we read a media report of a large, well-known organization that’s been the target of a cyber breach. Often sensitive data and client information is compromised and held for ransom by digital attackers. While the public usually only...

Ontario Insurers Alert Cargo Theft as a Big Threat

One of the biggest hits to a trucking firm’s insurance policy can be the theft of cargo and Ontario insurance companies are sounding the alarms to bring attention to this particular threat. Across the province, the transportation and logistics industry continues to...

Industry Recommendations to Help Insurance and Trucking Industries

The Insurance Brokers Association of Ontario (IBAO) and the Insurance Bureau of Canada (IBC) have partnered together to address insurance availability issues within the commercial trucking industry. For years, truck drivers with limited years’ experience, and their...

Good News for Property Owners and Snow Removal Operation Insurance Providers

Insurers, snow removal contractors, and commercial property owners in Ontario received some good news from the provincial government this month, ahead of the heavy snow fall season. A section of Bill 118, called the "Occupiers’ Liability Act”, will now limit claimants...

Why You Need Business Interruption Insurance

Insurance is bought to ensure if the unexpected happens, there’s a solution to make things better. Imagine an accidental garage fire: All of your possessions are lost, but insurance is there to get your items back and repair the damage. Now consider owning a business,...

Reopening Your Business in the Covid-19 Pandemic Environment

Tips to keep your workplace safe during COVID-19 The most important thing to remember is the health and safety of everyone - and that begins with employees. As always, under the Occupational Health & Safety Act (OHSA) business owners and operators are required to...

Covid-19: Changes to tell your Broker

With pandemic restrictions related to COVID-19 continuing to ease across Ontario and much of the province in Phase Two of the re-opening plan, there are important considerations to be aware of that may affect your insurance. More businesses have restarted operations,...

Covid-19: Business Planning for Safe Re-Opening

It’s been over eight weeks since government and health officials mandated the majority of businesses close their doors to the public. A lot has changed and everyone has needed to quickly adapt. After a long and patient wait, we are starting to see the slow re-opening...

Trucking and Transportation During Covid-19: Our Appreciation

With excepts from Staebler Broker Lisa Arseneau in the Rear View Mirror. Here we are: All isolated and distanced from each other in 2020. The COVID-19 pandemic has taken hold of our lives and changed things for everyone. It is an extremely proud moment in...

Insurance and Risk Management Considerations During a Pandemic

As COVID-19 spreads around the world, and the business environment changes daily due to government directives, organizations have found that there are many things to consider with respect to insurance and risk management. Property Coverage Many businesses are finding...

How To Adjust To Working From Home

With the escalating threat of the COVID-19 pandemic and a State of Emergency declared in Ontario, non-essential businesses are shutting their doors to the public. And many Ontarians are suddenly finding themselves being asked to work from home for the first time in...