how to become cyber insurance ready

How to Apply for Cyber Insurance

The following are the key elements that insurance companies are looking for to qualify your business for cyber insurance coverage.

Your best resource is a Staebler Broker who can help you navigate cyber insurance.

They can make sense of what’s required from you and provide recommendations to help protect your business’ valuable assets.

Special thanks to our network solutions partner Fortify for their assistance and expertise with this information.

get your business cyber insurance ready

ACCESS CONTROL

- Password Policy – complexity and forced regular changes

- Multi-Factor Authentication – for multiple access points

- Remote Access – Work From Home security

- Password Management – software to securely store

- Zero Trust Network Access (ZTNA) Strategy

- Dark Web Research and Monitoring

PERIMETER

- Firewall – implemented and managed

- Web Content Filtering – browsing the Internet is filtered

- Intrusion Detection System (IDS) – detect attacks

PATCH & UPDATE

- Operating Systems – servers and workstations

- Applications – individual user software

- Devices – firmware and systems

DATA

- Databases – encrypted at rest

- Other Data and Files – encryption at rest

- Backups – frequency, transferred offsite, testing of restoration, data AND critical servers/workstations

MONITOR & SCANNING

- Network Monitoring – detects performance issues

- Vulnerability Scanning – perimeter, applications, devices

- Penetration Testing – test ability to break in to network

- Security Information & Event Management (SIEM)

- Security Operations Centre (SOC)

DOCUMENTATION & PROCESS

- Business Continuity & Disaster Recover Plan

- Email & Internet Usage Policy – including social media

- Incident Response Policy

- Security Policy – how is information secured and stored?

- Change Management/Control Procedure

- Filtering – scanning emails for threats and spam

- Advanced Threat Protection – sandboxing of attachments

- DNS Management – email authentication/validation such as SPF, DKIM, Sender ID, or DMARC

- Data Loss Prevention

PEOPLE & BEHAVIOUR

- Cybersecurity Awareness Training and Testing

- Physical Building Security Measures

DEVICE SECURITY

- Virus/Malware Protection – servers & workstations

- Endpoint Detection & Response – servers & workstations

- Mobile Device Management – secure and manage access

- Asset Management – track and cycle older devices

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Cyber Insurance

Why Insure with Staebler?

Working with a broker brings experience, expertise, and advocacy to you and your organization. With an individual broker, you have the ability to personalize your insurance solutions for your unique needs. Find out why there are 7 Really Good Reasons to use an Insurance Broker.

Related Blog Posts

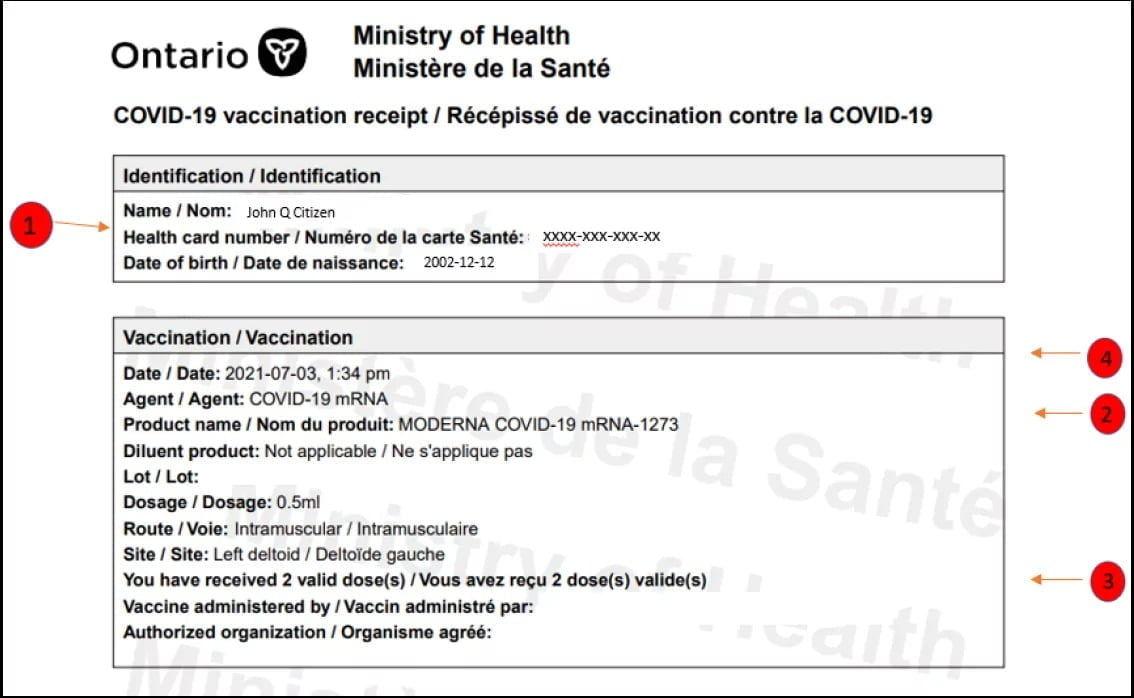

What Businesses Need to Know about Ontario’s Vaccination Certificates

Beginning Wednesday, September 22, 2021, the Province of Ontario is requiring proof of vaccination from patrons to enter select businesses. Ontario is joining other provinces with a vaccine certificate program that will eventually become a QR code (see update below)....

Why your Business needs Cyber Insurance in 2021

It’s becoming more frequent that we read a media report of a large, well-known organization that’s been the target of a cyber breach. Often sensitive data and client information is compromised and held for ransom by digital attackers. While the public usually only...

Ontario Insurers Alert Cargo Theft as a Big Threat

One of the biggest hits to a trucking firm’s insurance policy can be the theft of cargo and Ontario insurance companies are sounding the alarms to bring attention to this particular threat. Across the province, the transportation and logistics industry continues to...

Industry Recommendations to Help Insurance and Trucking Industries

The Insurance Brokers Association of Ontario (IBAO) and the Insurance Bureau of Canada (IBC) have partnered together to address insurance availability issues within the commercial trucking industry. For years, truck drivers with limited years’ experience, and their...

Good News for Property Owners and Snow Removal Operation Insurance Providers

Insurers, snow removal contractors, and commercial property owners in Ontario received some good news from the provincial government this month, ahead of the heavy snow fall season. A section of Bill 118, called the "Occupiers’ Liability Act”, will now limit claimants...

Why You Need Business Interruption Insurance

Insurance is bought to ensure if the unexpected happens, there’s a solution to make things better. Imagine an accidental garage fire: All of your possessions are lost, but insurance is there to get your items back and repair the damage. Now consider owning a business,...

Reopening Your Business in the Covid-19 Pandemic Environment

Tips to keep your workplace safe during COVID-19 The most important thing to remember is the health and safety of everyone - and that begins with employees. As always, under the Occupational Health & Safety Act (OHSA) business owners and operators are required to...

Covid-19: Changes to tell your Broker

With pandemic restrictions related to COVID-19 continuing to ease across Ontario and much of the province in Phase Two of the re-opening plan, there are important considerations to be aware of that may affect your insurance. More businesses have restarted operations,...

Covid-19: Business Planning for Safe Re-Opening

It’s been over eight weeks since government and health officials mandated the majority of businesses close their doors to the public. A lot has changed and everyone has needed to quickly adapt. After a long and patient wait, we are starting to see the slow re-opening...

Trucking and Transportation During Covid-19: Our Appreciation

With excepts from Staebler Broker Lisa Arseneau in the Rear View Mirror. Here we are: All isolated and distanced from each other in 2020. The COVID-19 pandemic has taken hold of our lives and changed things for everyone. It is an extremely proud moment in...

Insurance and Risk Management Considerations During a Pandemic

As COVID-19 spreads around the world, and the business environment changes daily due to government directives, organizations have found that there are many things to consider with respect to insurance and risk management. Property Coverage Many businesses are finding...

How To Adjust To Working From Home

With the escalating threat of the COVID-19 pandemic and a State of Emergency declared in Ontario, non-essential businesses are shutting their doors to the public. And many Ontarians are suddenly finding themselves being asked to work from home for the first time in...