Staebler Knows Insurance for Non-Profits & Social ServiceS

Caring as Much as You do to Protect Your Organization

Insurance for Non-profits and Social Services

We understand the unique challenges faced by NFPs and social service organizations. With years of experience and a deep understanding of the industry, we provide comprehensive insurance solutions that protect your organization, your employees, and your property.

Our team of experienced insurance brokers are committed to delivering the best coverage, and will work with you to develop tailored coverages that meet your specific needs in the nonprofit sector, including:

- Registered Charities

- Corporations and organizations holding charitable status

- Foundations and Associations

- Trusts and Cooperatives

- Social Services

- Not-For-Profits

Simply request a quote below to learn more about our tailored insurance solutions and how we can help safeguard your organization.

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Non-Profit and Social Services Insurance

Why Staebler Insurance?

TRUSTED ADVISOR

We’re here to help you. It’s not a slogan, it’s our reality. With decades of trucking experience, backed up with a dedicated service team, Staebler Insurance is your partner with advice and advocacy.

RISK MANAGEMENT

We understand the unique risks faced by the charitable sector and provide customized risk management solutions that minimize exposure to potential losses.

WORKING FOR YOU

The insurance market is complicated and it’s not worth going alone. A Staebler Broker knows the market and what’s required for your unique needs. Put our expertise to work for you!

Important Social Services Insurance

PROPERTY

This covers your physical property including your buildings, your equipment, your materials or stock, tools, office furniture and more.

Not insuring to the full value can cost you! If you don’t have the right amount of insurance, your claim payment will be reduced. And remember, there is a difference between market value and rebuild/replacement cost.

DIRECTORS & OFFICERS (MANAGEMENT LIABILITY)

Your personal liability is not enough! This covers your personal liability for wrongful acts as a director or officer of the organization.

GENERAL LIABILITY

Your personal liability is not enough! This covers your legal bills and settlements made against you and your business.

Cyber Insurance

Cyber Liability Insurance defends against the financial impacts of cyber attacks, including data breaches, ransomware, and hacking incidents. It covers costs like legal fees, customer notifications, credit monitoring, and business interruption losses.

Learn more: Cyber Insurance

ERRORS & OMISSIONS (PROFESSIONAL LIABILITY)

General Liability is not always enough! This provides coverage for your errors in your professional service and counsel to your clients.

Abuse Liability Insurance

Covers your legal bills and settlements made against you and your business, resulting from alleged incidents of abuse.

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Non-Profit and Social Services Insurance

Speak with a Social Services Insurance Specialist

Anita Flootman Paterson

B.Sc. (Hons), RIB (Ont), CIP, CRM

Vice President, Broker, Commercial Solutions

Related Blog Posts

Security for Your Home & Business this Holiday Season

With the holiday season upon us, our focus shifts to decorating, shopping, festivities, baking, and possibly travel. To help keep the holidays cheerful and safe, we bring you some essential tips and recommend some easy-to-follow steps to protect your homes and...

How to Make Your Business Cyber Insurance Ready

If you’re a business owner, you’ve probably heard quite a bit lately about cyber insurance. Not only are you hearing about the usual stats about cyber attack this and cyber breach that, but now the difficulty in even being able to get cyber insurance coverage for your business.

Do I Need Small Business Insurance?

Heading down the entrepreneurial path and opening a business can be a rewarding experience. Of course, there are challenges along the way, from staffing to supply chains to marketing and sales. There are also lurking risks that can befall an owner when they least...

Business Interruption Insurance Claims can be Affected by Supply Chain Challenges

In a previous blog, we discussed how insured property values may need to be increased because of a number of inflationary factors affecting restoration costs. These continue to include high construction costs (material, labour, etc.) and increased demand for these...

What you Need to Know About Inflation and your Insured Property Values

Since 2020, the world has seen supply chain problems, catastrophic weather events, wars, political upheaval, and viruses. All of these events have put upward pressure on costs for everything, including construction costs. Costs of labour and materials have...

Where’s the Best Place for Brunch in Waterloo Region?

PSA: Mother’s Day is less than a week away! Don’t panic, there is still time to do something special for Mom. Instead of getting her another gift card or an apron with cats on it, you should splurge for a nice brunch out. Support local while leaving the cooking and...

What are the Best Food Trucks in Waterloo Region?

With the warmer weather, thoughts of summer jump into many people’s minds, and with it comes the urban rituals of parks, splash pads, and food trucks! Who doesn’t love a tasty meal or a quick bite from a food truck on a summer day? In the last several years, food...

What you need to know to be Cyber Secure in 2022

It’s a trend that continues to be more prevalent every year. Last summer the Staebler blog reported the unfortunate increase in security breaches, ransomware demands, and other data attacks on corporate systems. Now, Cyber Insurance is one of the most asked about...

How to Keep your Commercial Property Safe this Winter

With Ontario's "Slip & Fall" Claims Period Reduced, Here's What You Need To Do The cold weather is here - bringing with it snow and ice, meaning that potentially dangerous walking conditions could be lurking around every corner. Responsible commercial property...

What your Business needs to know about Compiled Financial Information

Important Changes Coming for Financial Statements For the first time in more than 30 years, the Chartered Professional Accountants of Canada (CPA) have updated its accounting standards for financial statements. The new rules help define what an accountant needs to...

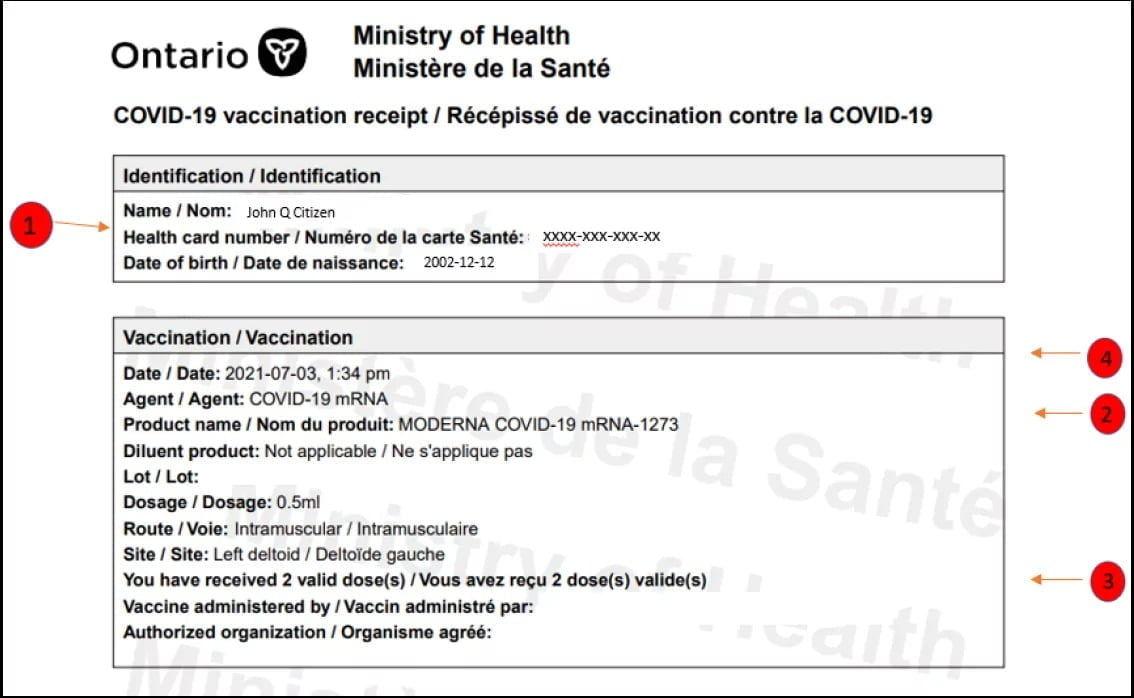

What Businesses Need to Know about Ontario’s Vaccination Certificates

Beginning Wednesday, September 22, 2021, the Province of Ontario is requiring proof of vaccination from patrons to enter select businesses. Ontario is joining other provinces with a vaccine certificate program that will eventually become a QR code (see update below)....

Why your Business needs Cyber Insurance in 2021

It’s becoming more frequent that we read a media report of a large, well-known organization that’s been the target of a cyber breach. Often sensitive data and client information is compromised and held for ransom by digital attackers. While the public usually only...