Waterloo Region’s transportation infrastructure was transformed with the launch of ION light rail transit (LRT) in the summer of 2019. The frequently running trains connecting points in Kitchener and Waterloo are a boon for public transit and in the past five-plus years has become a strength for the region.

Regrettably from time to time there are collisions with the LRT as the trains traverse through urbans centres and heavily populated areas of the cities. As much as signage and signals try to avoid these and warn drivers about trains approaching, collisions still happen.

So, does car insurance cover a crash with the LRT?

The short answer is yes but it can really depend on your individual car insurance policy.

Most standard car insurance policies include collision coverage, which covers damage to your vehicle caused by hitting another object, when you (the operator) are at fault. A light rail train qualifies, so if you have collision coverage, you’re likely covered for repairs to your car after such an accident (minus your deductible). However, since collision coverage is optional, if you don’t have it, you’d be out of luck unless, perhaps, the train operator or transit authority is found liable.

Liability may be a factor too. If you’re at fault, e.g. you ignore a signal or drive onto the tracks, your liability coverage won’t help with your car’s damage, but it may cover damage caused to the train or injuries to passengers, up to the policy’s limits.

Other Coverage Considerations

As mentioned above, if you’re found liable for a collision with an LRT vehicle, your policy’s liability coverage might be called upon to repair any damage to the LRT vehicle as well as any injuries to passengers onboard.

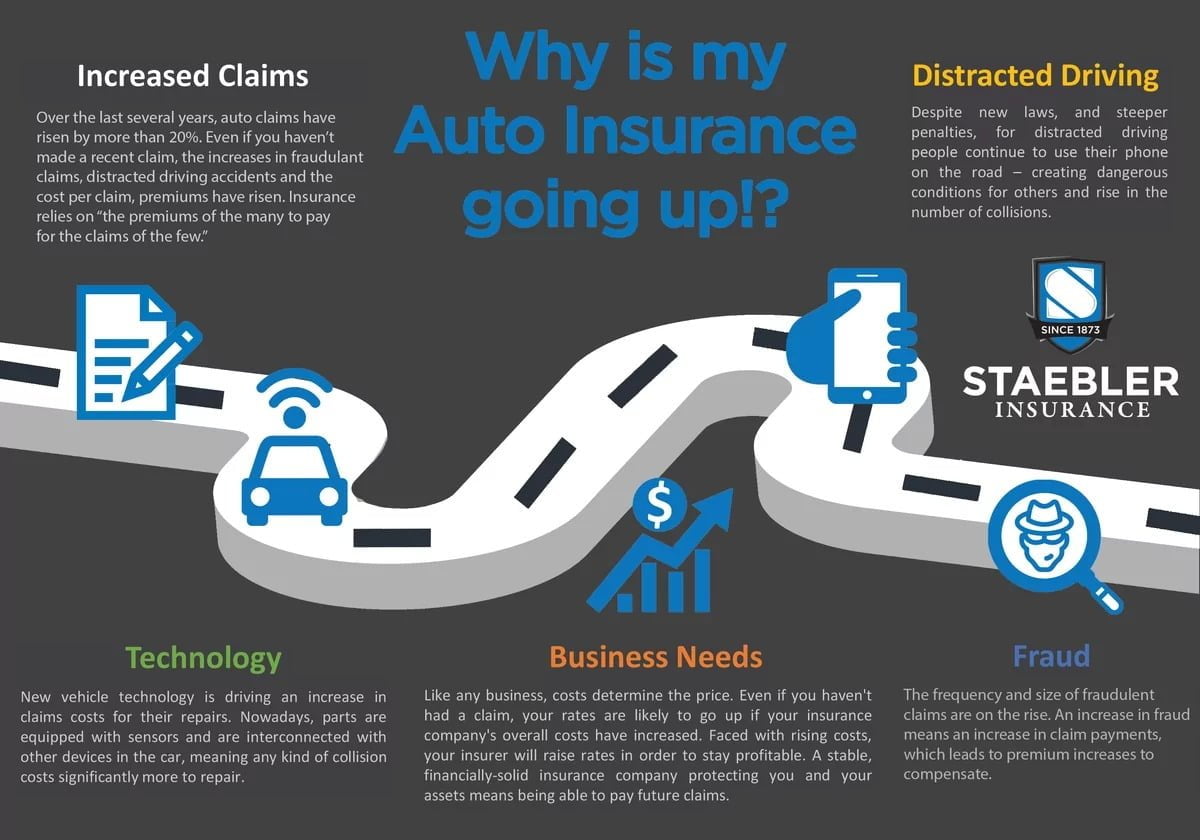

Those claims costs can add up quickly! It’s a great opportunity to review your current coverages, consider increasing your liability coverage, or possibly adding an umbrella liability policy. Speak with a Staebler Broker for details.

In addition, if you live near the LRT line, you might also consider comprehensive coverage, which can protect against unexpected events. A scenario could be a collision where the train derails and is completely unrelated to your driving.

Generally, if you have collision coverage, you’re likely safe for your car’s repairs. Without it, you’d need to prove the transit operator’s fault or foot the bill yourself. Either way it’s important to obey all transit signs, signals, and always stay off the tracks.

For more information about Waterloo Region’s ION light rail transit, please visit: ION light rail – Grand River Transit

. . .

Staebler Insurance is a general insurance broker specializing in car insurance, home insurance, small business insurance, and commercial insurance. Staebler Insurance Brokers proudly serve Kitchener, Waterloo, Cambridge, Guelph, Stratford, Listowel, Fergus, Elora, Wellington County, Perth County, Waterloo Region, the Greater Toronto Area, Golden Horseshoe, Niagara Region, and all over beautiful Ontario, Canada. Get a Quote to get started today.

0 Comments