As a broker, one of the most common questions we receive throughout the year is “Why are my auto rates going up?” There are many factors that go into insurance premiums, so we as brokers can appreciate that it can be confusing – so we always like to find opportunities to shed some light on the factors that are influencing auto premiums.

What can make this issue even more complex is that automobile insurance rates can involve more than just an individual’s record of things like tickets, accidents, and changes to the car or to the driver’s status, but it also involves the trends affecting the automobile insurance of all drivers as a whole.

How do Rates Change?

It’s important to note that any rate changes to automobile insurance must be approved by Ontario’s Financial Services Regulatory Authority (FSRA). How it works is insurance companies apply for rate changes and must justify their request with evidence, such as claims experience and loss ratios.

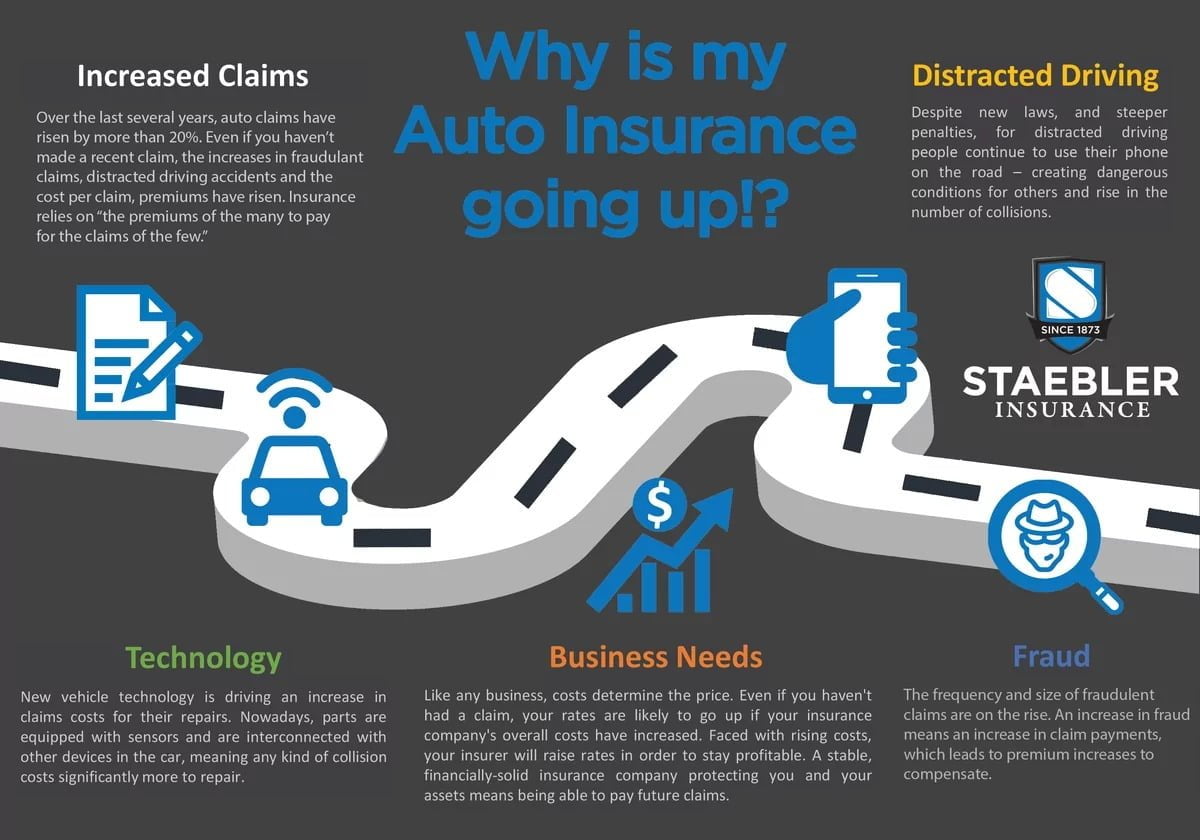

But why do insurance companies raise auto insurance rates? There are many factors that can affect automobile insurance claims, so we’ve highlighted a few that have had a significant impact on auto insurance rates in recent years.

FRAUD

One of the biggest contributors to insurance prices in Ontario is insurance fraud. A few bad apples in recent years have hurt insurance companies for unnecessary and unrealistic claims. Added costs like “staged” accident benefits claims and bogus car repairs have put insurers at financial risk with the need to raise rates. Fraud can take many forms – it be anything from a bogus accident to inflating claims costs associated with an otherwise legitimate accident.

REPAIR COSTS

Newer and more sophisticated technology built into modern vehicles contributes to higher repair costs. A simple fender bender in the past was a straight-forward fix, but now with smart sensors and rearview cameras on bumpers, that repair is significantly more expensive!

DISTRACTED DRIVING

Distracted driving also contributes to higher risks for drivers on the road. Drivers preoccupied with sending a text instead of watching the road ahead has contributed to a higher number of accidents. With Distracted Driving rates on the rise, the increased rate of accidents means increased auto insurance premiums to offset the increased losses.

Looking Ahead

What’s the insurance market look like in 2021? As the calendar turns, there’s optimism that pre-pandemic activity is possible again, however that doesn’t mean insurers will be quick to change rates one way or the other.

“Insurers have been cautious in their approach. Other than the first few months of the pandemic, you’re not seeing insurers just cut premium rates … 10-15%. They’re taking a more cautious approach because they’re unsure about driving levels and 2021,” insurtech analyst Mike Zaremski told Canadian Underwriter.

In the meantime, the reduction in vehicle travel means increased competition for those low-mileage drivers is expected to pick up.

Another Option – CAA MyPace

CAA MyPace is a pay-as-you-go auto insurance option that is geared to low-mileage drivers, specifically those who drive fewer than 9,000 km per year. Drivers can buy insurance in 1,000-km increments as they need it. The MyPace product launched in 2018 in Ontario and is available from your Broker at Staebler Insurance.

. . .

Staebler Insurance is a general insurance broker specializing in auto insurance, home insurance, small business, and commercial insurance. Staebler brokers proudly serve Kitchener, Waterloo, Cambridge, Guelph, Stratford, Listowel, Fergus, Elora, Wellington County, Perth County, Waterloo Region and southern Ontario. Click here to get started.

0 Comments