Group Rate Insurance Program

Save up to 25% with Staebler’s Group Rate Home & Auto Insurance Program

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Group Rate Insurance Program

Group Rate Insurance Savings

Save Money

Personal Service

Easy Payment Plan

Easy to Switch

Added Perks

Enjoy the peace of mind of a brokerage backed with over 150 years of local service and experienced brokers who will advocate for you.

You Could Win an iPad!

Many of our Group Rate Insurance Program employers choose to participate in our annual iPad prize draws.

Congratulations to all of our 2025 iPad winners! To qualify for our upcoming 2026 prize draws, simply Get a Quote from a Staebler Insurance Broker.

Draw date: Stay tuned, date to be determined in 2026.

If you work for one of these GREAT EMPLOYERS, you are eligible to begin saving

Click your employer to get started!

No Group Plan where you work? Ask your employer to call and find out how easy it is to sign up for this free employee perk!

EMPLOYERS: Discover our Group Insurance Plan.

SIGN UP FOR A REAL EMPLOYEE PERK!

Staebler’s Free Group Rate Insurance Program

Discounts on Home and Car Insurance for your employees

A dedicated, RIBO-licensed broker for your employees

Eligible for Referral Rewards! Learn more

24/7 Claims Assistance and Advice

Free Marketing and Promotions provided by us

No-cost program for employers and all insurance conversations handled by our brokers

Get A Quote

Fill in the form and one of our brokers will contact you soon.

Group Rate Insurance Program

Meet Staebler’s Group Sales Team!

Dawson Ladouceur

BCom, RIBO, Sales Broker, Personal Solutions

519.743.5228 x267

[email protected]

Dawson joined Staebler Insurance from York University after a successful university football career and earning a BCom (Bachelor of Commerce) degree. Dawson was drawn to the insurance industry while working at an IT company that serviced insurance brokerages. Encouraged by clients, he decided to give the Insurance Broker role a shot, and through self-study, he earned his RIBO (Registered Insurance Broker of Ontario) licence.

Liam Chatterson

RIBO, Sales Broker, Personal Solutions

519.743.5228 x310

[email protected]

Liam is a Sales Broker on our Personal Solutions’ team. He brings a fresh perspective and a passion for building strong client relationships. With a focus on home and auto insurance, Liam leverages communication and people skills, developed through work experiences in real estate, hospitality, and construction. He has earned his RIBO (Registered Insurance Broker of Ontario) licence, highlighting a commitment to the industry where he says he’s found his calling after being recommended by a close friend.

Related Blog Posts

Record Gas Prices in Kitchener-Waterloo! The Top Ways to Save on Gas Mileage Today

With gas prices souring around Ontario this month, drivers are frustrated and there’s no question they’re looking for ways to save. Industry experts are suggesting there isn’t an end in sight so we have a few ways you can make your next fill up last longer. Slow your...

How Long Does a Ticket Stay on my Driving Record?

Earlier this month the provincial government introduced steeper penalties for speeding and stunt driving offences. The new laws are targeting the most dangerous of drivers on the road, including those drivers who are caught driving too much over the speed limit. One...

What are the New Penalties for Street Racing and Stunt Driving in Ontario?

The provincial government introduced new laws on July 1 to help slow down speeders and make Ontario roads safer. The Moving Ontario More Safely Act begins by targeting aggressive driving, stunt driving, and street racing. They are lowering the threshold for tickets...

Electric Car Popularity Accelerates in Waterloo Region

The pursuit of a cleaner future relies on the actions of individuals. Making the decision to change from a gas-guzzling car or truck to an electric vehicle is one of those actions. In Waterloo Region, that action is becoming more and more of a trend. A recent...

Driving Less, Driving Safer? Pay As You Go Insurance in Kitchener-Waterloo May be the Answer

Good drivers in Waterloo Region and those who are driving significantly less than prior to the pandemic, are seeking alternate auto insurance options. Insurance companies are seeing the changing habits and behaviours of drivers, and have expanded the choices to meet...

Kitchener Joins Cambridge and Waterloo with A No-Idling Bylaw

The City of Kitchener announced this week their new anti-idling bylaw, which moves Kitchener more in line with similar bylaws in the neighbouring cities of Cambridge and Waterloo. The new rule targets drivers who keep their engines running for more than three minutes...

Top Ways to Save on Your Car Insurance

In our last blog we discussed why auto insurance rates are going up. Unfortunately as an individual driver many of those factors are out of your control. But there are some things you can control and they can help lead you to savings on your auto insurance premiums...

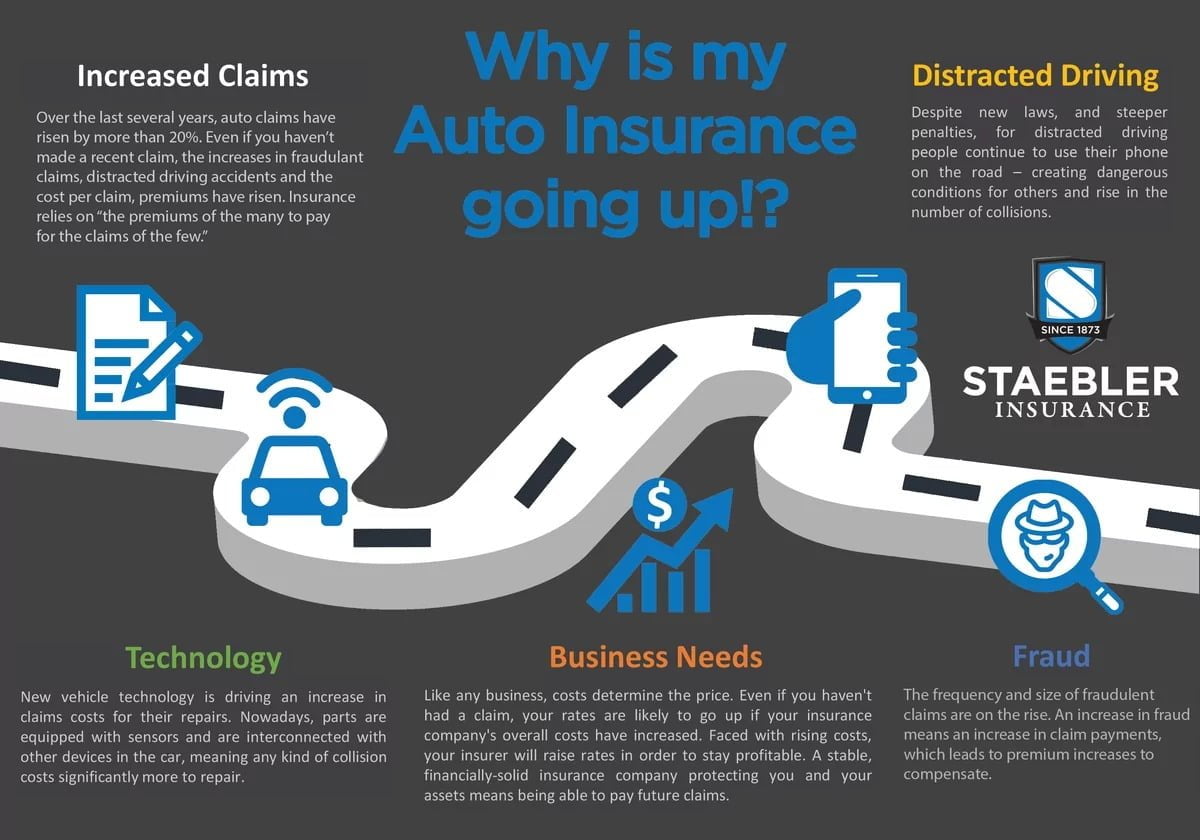

Why Are My Auto Rates Going Up?

As a broker, one of the most common questions we receive throughout the year is "Why are my auto rates going up?” There are many factors that go into insurance premiums, so we as brokers can appreciate that it can be confusing – so we always like to find opportunities...

What are the Top 10 Stolen Vehicles in Canada?

Every year the Insurance Bureau of Canada releases the list of the most stolen vehicles across the country. There’s a clear trend in 2020 as eight of the top 10 vehicles on the list are SUVs while the other two are pickup trucks. According to the IBC, auto theft costs...

DISCLOSURE

Staebler Insurance, in partnership with Northbridge General Insurance Corporation, offers a group program discount on personal automobile and personal property insurance to employees and retirees of select organizations. Discounts can be up to 25% off the regular retail rates. Active/current employees and retirees of select organizations are eligible for the program, and access to the program continues until the termination of employment or the termination of the group program. The organizations noted above have no financial interests in the program.

Staebler Insurance brokers are available to assist you with any updates, changes, and inquiries you have: Contact Us

Staebler Insurance is compensated by standard insurance broker commissions, as outlined here: Treating Customers Fairly